Christine Murray, Nassos Stylianou, Irene de la Torre Arenas, and Dan Clark

Financial Times

December 15, 2024

On a recent Friday morning in Alianza Industrial Park, dust billowed up as diggers and lorries cleared land near a site for Chinese tyre maker ZC Rubber. A crane was poised to lift material for lithium and lead battery maker Leoch. A sign at its entrance welcomed another new firm in Mandarin and English.

Germany’s Daimler Truck and multinational giant Stellantis have been making vehicles on adjacent sites for more than a decade. On the surrounding land, suppliers from Europe and the US produce everything from windows to wire harnesses.

Alianza is one of multiple sites in Mexico with a growing Chinese presence that seeks to take advantage of the country’s free trade agreement with the US and Canada, known as USMCA.

That has drawn the attention of politicians in Washington and Ottawa, just as president-elect Donald Trump threatened Mexico’s government with 25 per cent tariffs if it cannot stop the flow of migrants and drugs north.

FT analysis shows that over the past few years, Chinese companies have established themselves deeper into supply chains, developed stronger trade links and increased manufacturing in Mexico.

“From a purely economic perspective, significant Chinese investment activity in Mexico is going to raise alarm bells in DC,” says Connor Pfeiffer, director of congressional relations at US national security think-tank FDD Action.

“Mexico is right here, and they have a very different set of access to the US market than some of the other countries.”

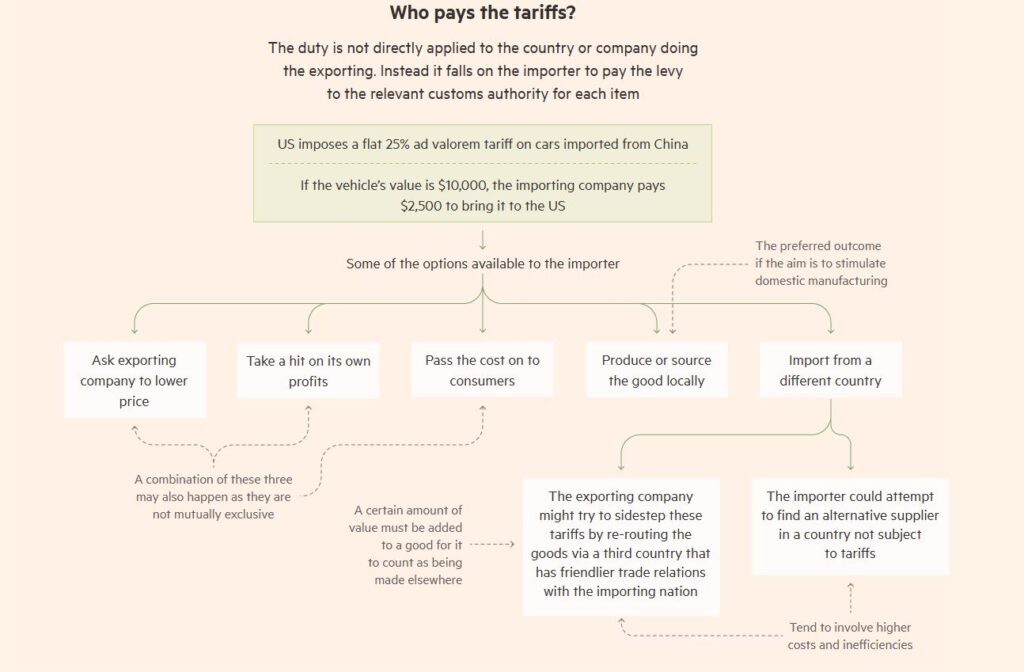

Although Chinese companies are investing in many countries to try to diversify their supply chains, including close neighbours such as Vietnam, Mexico’s proximity, trade access and centrality to other Trump priorities like migration and drugs put it squarely in the line of fire.

Trump’s pick for secretary of state, Marco Rubio, and Canadian Prime Minister Justin Trudeau have both expressed concerns that China is using Mexico to circumvent tariffs.

The USMCA, which underpins trade between the three nations, is up for review in 2026, with China’s present and future role in supply chains likely to be central.

Mexican government statistics show investment from China and Hong Kong was $450mn last year, less than 2 per cent of the total. But data from external research providers suggests China is likely to be a more significant investor than official figures suggest.

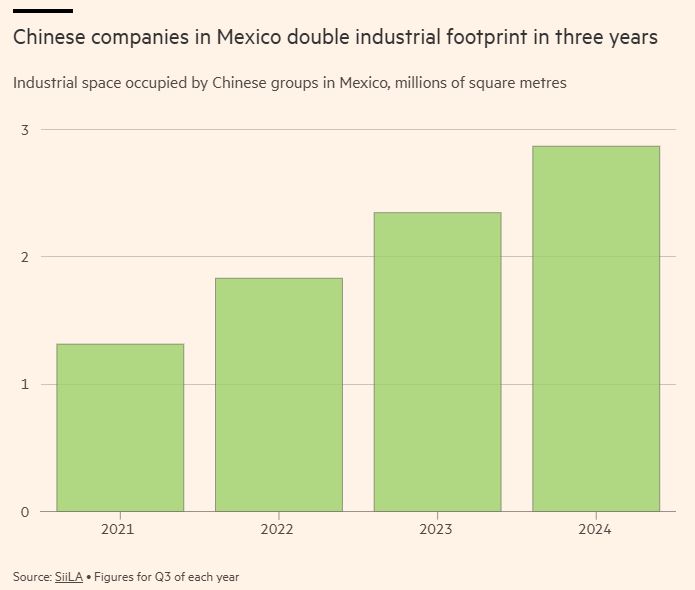

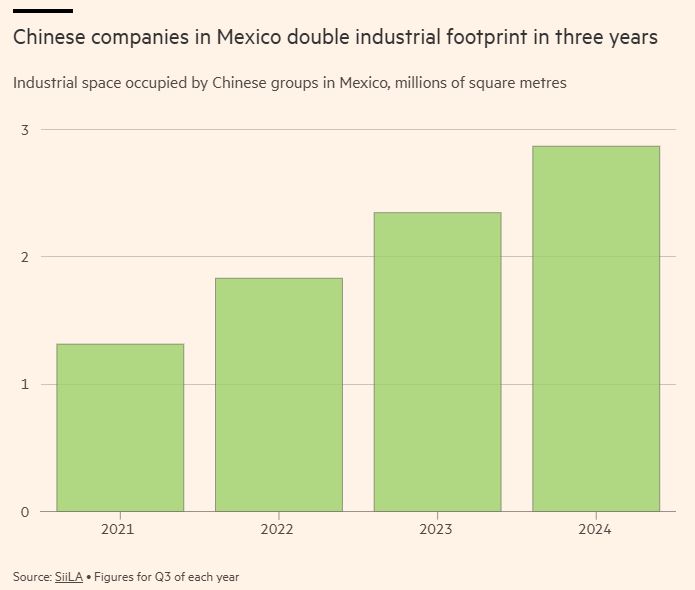

Chinese groups in Mexico occupy twice as much industrial space as they did three years ago, figures from property analytics company SiiLA show. While they make up just 3 per cent of tenanted industrial space, according to the latest numbers, they have filled 7 per cent of the absorbed capacity since 2020, the third-largest behind US and Mexican firms.

Mexican business leaders point out that although there has been growth in Chinese investment, it is from a small base and the levels are far lower than in many South American nations.

But its growing presence and visibility is a challenge for Mexico’s new president, Claudia Sheinbaum, as she attempts to build a relationship with Trump.

“I really don’t think that the sudden increase in Chinese presence is the flood the US discourse suggests . . . but that doesn’t mean we should ignore it,” says Juan Carlos Baker, director of Ansley Consultores who previously ran foreign trade at the Mexican economy ministry.

When ZC Rubber started construction on its plant in Coahuila in August, state officials gifted company representatives a Mexican tapestry and a statue of the country’s coat of arms, an eagle perched on a prickly pear cactus fighting a rattlesnake. The company’s investment accounts for almost half of the more than $1bn promised by Chinese businesses in Alianza Industrial Park.

A month later, as another Chinese firm broke ground on its factory nearby, the officials cut red ribbons while traditional Mexican dancers put on a show.

The state government of Coahuila — which shares a 512km border with Texas — has been particularly proactive with attracting Chinese business. Governor Manolo Jiménez went to the Beijing auto show this year touting the state’s advantages, which include efficient connections to the US and successful security policies.

“Whatever the country of origin, companies generally want local integration where they don’t struggle with infrastructure,” César Cantú, president of Grupo Alianza, which owns the park, says. “It’s not exclusive to Chinese or Japanese or American companies, companies that aim to sell in the biggest market in the world have to set up near that market.”

Government FDI data shows the state was the second-largest recipient of Chinese investment in 2023. That spending is part of a growing trend, but many experts believe the official FDI numbers undercount the true levels. Data from fDi Markets backs this up, suggesting that what is recorded is just a fraction of what is announced by Chinese companies.

In a recent report, consultants at Rhodium Group also estimated that the stock of investment could be six times higher than the government’s numbers.

It reflects well-known distortions and limitations of how FDI is counted, which presents a challenge for Mexico as it tries to address US concerns — and also decide what Chinese investments it will or will not allow due to fears of unfair competition or national security.

“When I worked in the economy ministry, this wasn’t something that really worried us,” Baker says, adding that he thinks Mexico needs to change its laws to track investment more closely. “If we don’t know the real number of Chinese investment, where it’s coming from and who is generating this capital, we should know.”

Inside the “‘Mexico Mart” shopping centre in downtown Mexico City, which has its full name in mandarin above the entrance, dozens of vendors sold Chinese imported goods on the cheap.

That was, until a government raid last month that shut it down as armed marines stood watch outside. The move was widely understood as a signal to the US that Mexico was willing to crack down on Chinese imports, though reducing them is not an easy task.