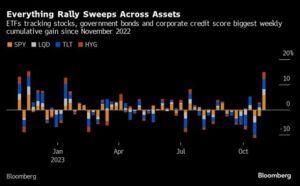

The S&P 500 and the Nasdaq 100 both had their best week of the year with gains of around 6%. The 10-year Treasury yields fell more than 25 basis points, the biggest weekly drop since March. As stocks rose, the world’s largest Treasury exchange-traded fund rallied 4% as investment-grade and junk bonds moved up in tandem. Cumulatively, it was the biggest upside move in 17 months, according to data complied by Bloomberg. (Commodities narrowly missed out.)

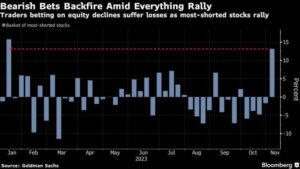

How ingrained had gloom become? The run-up followed a three-month selling spree by hedge funds that was the second-biggest of the past decade, according to data tracked by Goldman Sachs Group Inc.’s prime brokerage. Net short bets on Treasuries held by professional speculators were hovering close to the highest level on record going into the latest bond rally, Commodity Futures Trading Commission data showed.

Both views took lumps. Investors wagering on stock declines were hit particularly hard, with a basket of most-shorted companies gaining 13%.

Meanwhile, Cathie Wood’s flagship ARK Innovation ETF (ARKK) had its best week on record rising nearly 19% as rate-sensitive speculative tech stocks got a boost as traders have been reducing rate-hike bets.

Fast-money quants like commodity-trading advisers are sitting on a $302 billion record short bet in bonds, according to Scott Rubner, a managing director at the bank who has studied the flow of funds for two decades.

“We are in early innings of the short-cover rally,” Rubner said. “We have seen a shift from fundamentals to technicals in November given the return of corporate buybacks, large systematic demand in fixed income and equities, short covering in popular thematic shorts, and increase in record low net hedge fund exposure.”

He estimates the cohort may snap up around $105 billion of bonds over the next month if prices remain largely unchanged — and as much as $456 billion if this week’s advance continues. The short positioning of CTAs in stocks could also lead to an $81 billion S&P 500 futures buying spree if the upside momentum holds.

Among the week’s catalysts, two were straightforward. The US Treasury signaled Wednesday it plans to slow the rate of growth in quarterly debt sales, quelling — for now — worst-case anxieties that surging supplies of government bonds would elongate a nearly two-year rout in Treasuries. And Friday’s weaker-than-expected employment report suggested the labor market was succumbing to the Fed’s efforts to cool it.

In between was an address by Powell that investors interpreted in a dovish fashion, despite repeated assurances from the Fed chief that decisions about future rate cuts have yet to be made and will depend on incoming data.

Traders keyed on Powell’s observation that rising long-term bond rates may work to subdue inflation by tightening the screws on the economy. They also cheered remarks implying that hawkish forecasts issued by central bankers in September are fading in relevance — “the efficacy of the dot plot probably decays,” he said, adding the rate-hike cycle has “come very far.”

“The Treasury and Fed responded to the market and now the market is responding to Treasury and Fed,” said Priya Misra, a portfolio manager at JPMorgan Asset Management. “Data this week supports the Fed patient stance. Risk assets will get nervous if a recession looks imminent but that’s not today’s story.”

Fed swaps now show traders see an only 16% chance of another hike by January, and have fully priced in a cut by June — instead of July.

For Emmanuel Cau, head of European equity strategy at Barclays Plc, “the macro environment remains precarious.”

“The bar is low for a bounce on rates relief and peak duration pain,” Cau wrote in a note. “Transmission mechanism from tighter monetary policy works with a lag and central banks are unlikely to reverse course unless something breaks.”