Ben Eisen

Wall Street Journal

November 28, 2024

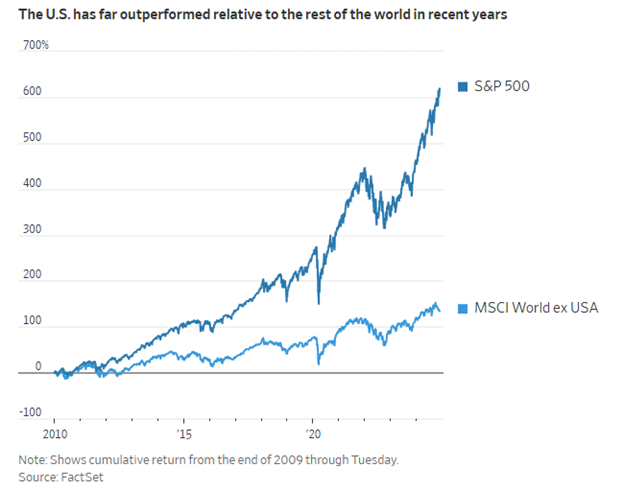

U.S. stocks have been euphoric lately—and they’ve left international stocks in the dust.

The longtime performance gap between the two is widening. Since the end of 2009, an MSCI index tracking equities outside the U.S. has only topped the S&P 500 in two years, according to Dow Jones Market Data. During the S&P 500’s banner 26% rise this year, the index has risen roughly 3%. If that holds through the rest of the year, it would be the biggest performance gap in nearly three decades.

Investors are now in a bind: Hold on to something that keeps falling behind, or sell it when it’s potentially at a low point? Investing history suggests that stock-market dogs bounce back eventually.

Millions of American investors are likely facing that dilemma, particularly as a new Trump administration gets set to change the U.S.’s relationship with the world. If you have a target-date retirement fund, foreign stocks make up nearly a quarter of it on average, according to Morningstar Direct. The share has held pretty constant over the past few years.

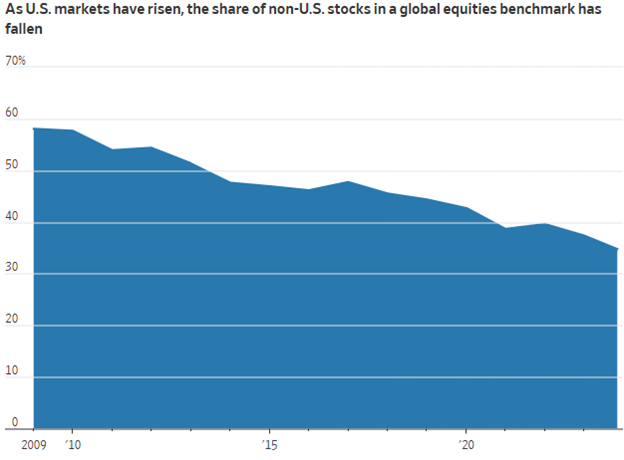

The $19 billion Fidelity Freedom 2050 Fund, for example, has about 45% of its stocks outside the U.S. It is higher than the benchmark MSCI index that tracks the entire world’s stock market, where only about a third of its weight is outside of the U.S.

Investors in similar funds might not be aware of their exposure to these stocks.

“That’s a pretty significant bet,” said Jason Kephart, director of multiasset ratings for Morningstar. “When you have big bets like that, you’re either really right or really wrong.” A representative for Fidelity said its “investment team believes diversification is the best way to manage uncertainty in capital markets over extended investment horizons.”

Interconnected world

Some investors are throwing in the towel on international stocks.

Rex Gordon, a 41-year-old pharmacist in the Philadelphia area, sold his target-date fund a few years ago and put his investments all in U.S. stocks. He splits his holdings between large-capitalization companies, midcaps and small-caps, a mix he has been pleased with.

Gordon decided he doesn’t need international stocks because he gets exposure to those economies through the largest U.S. companies, such as McDonald’s and Microsoft, which have significant foreign sales.

“The way the world economy is now, it’s so interconnected,” he said. “I look at them as international companies on their own.”

Since the end of 2021, U.S. investors have pulled some $3.3 billion from international stock exchange-traded and mutual funds while putting nearly $73 billion into U.S. funds, according to Morningstar Direct.

The case for international stocks

One case for owning foreign stocks is that the rest of the world might do well when the U.S. is doing poorly, and vice versa.

In the 1980s, when the Japanese market was roaring, international stocks blew past the U.S. The Nikkei peaked around the end of that decade, then slumped for so long it only recently surpassed that record high. If the U.S. market fell into a similar rut, international stocks could power investor portfolios higher.

Between 1950 and 2022, a hypothetical portfolio of 70% U.S. stocks and 30% international stocks would have performed about the same as a portfolio of all U.S. stocks, but with less volatility, according to Fidelity Investments.

Some brokerages recommend keeping anywhere from 20% to 40% of stocks in international companies as part of a diversified portfolio. People who tap financial advisers are more likely to hold international stocks than those who build their own portfolios, according to Vanguard Group.

“It’s like their mantra: You need to get international stocks in your portfolio,” said Eric Figueroa, who is among the financial advisers telling clients the opposite.

The Folsom, Calif.-based adviser says, “the pain-to-benefit ratio isn’t worth it” for a buy-and-hold portfolio, given their performance. He also dislikes the currency fluctuations that can affect returns.

Changing winds

Lately, international stocks have performed so poorly that Bank of America analysts think the time is right to buy Chinese and European stocks. They reason that bad sentiment is bound to reverse after getting so extreme.